Senior Editor of Kiplinger’s Personal Finance Magazine Jane Bennett Clark said MSU’s values decreased between the 2009-2010 and 2010-2011 academic years.

“While MSU did go up in the quality criteria, it also went up in cost,” Clark said.

Although most of the schools on the list saw cost increases, Clark said MSU’s lower value mostly is because of the significant improvements in quality of other universities.

The values of universities were determined more by the quality of the university than the cost in the rankings, she said.

“(For) our first sweep of colleges, we start with the criteria such as student-faculty ratio, consider admission rate and yield and the test scores of incoming freshmen,” Clark said.

Once the magazine calculated the quality of the schools, it went back and looked at the financial value of each university, she said.

Journalism and advertising senior Ansley Prior said choosing the right school was more about the reputation of the professors and the programs than the cost.

“I came here for the journalism program and the designers here,” Prior said.

Bottom of the Big Ten

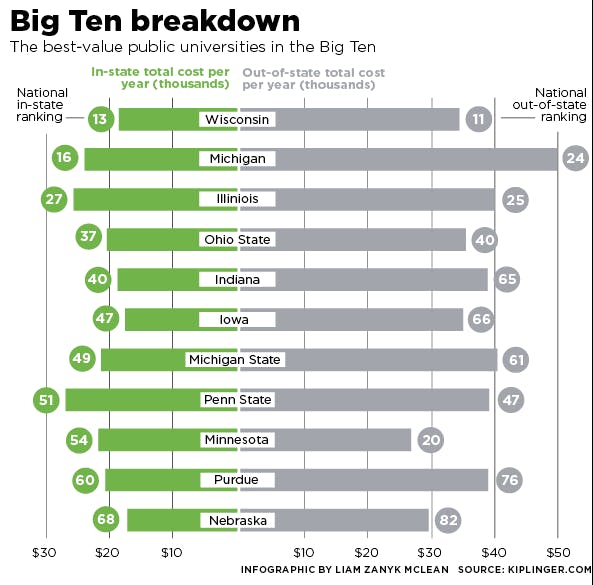

MSU’s in-state ranking was toward the bottom of the list compared to the other ten public Big Ten universities, ranking seventh in the conference. Northwestern University was not included in the report because it is a private school.

The University of Michigan received a ranking of No. 16 in-state, ranking them second in the Big Ten behind the University of Wisconsin at No. 13. The University of North Carolina at Chapel Hill ranked No. 1 on the list.

Clark said although MSU’s quality improved compared to the 2009-2010 results, the financial value of the school decreased as the cost of tuition rose.

Economics Professor Charles Ballard attributed the rise in tuition rates to the funding cuts MSU saw from the state government during the past few years.

“The Granholm-Snyder years have been characterized by huge cuts in higher education funding,” Ballard said.

Debt on the rise

The magazine also chose to put more weight on the amount of debt students have when they graduate, causing MSU to lose points, Clark said. MSU’s average debt at graduation was $21,818, according to the report.

Associate Director of the Office of Financial Aid Val Meyers said the office is careful when advising students to take out student loans to prevent students from graduating with a large debt.

“If a student is eligible for a loan, we try to counsel students to only borrow what they really, really need,” Meyers said. “Maybe they could work a little more or look for scholarship funding to not take out what they do not absolutely need.”

In the 2010-2011 academic year, Meyers said the Office of Financial Aid reported 35,758 students received some form of financial aid.

Of the students receiving financial aid, 29,973 were from the state of Michigan and received from the state of Michigan.

Support student media!

Please consider donating to The State News and help fund the future of journalism.

About 16 percent of students who received financial aid were out-of-state students, and about 1,095 students were international students, while 3,880 students were from the U.S.

Although some out-of-state students are required to pay $40,297 per year — about 53 percent more than the in-state rate of $21,352 per year — Meyers said the Office of Financial Aid is more likely to give out-of-state students federal aid.

“We do give more federal aid to out-of-state students because they are not part of in-state (aid),” Meyers said. “We try to help them receive federal aid because their costs are so much higher.”

Accounting sophomore Ashley Kim, an international student, said she received no financial aid to attend MSU, and her parents are paying her tuition.

“I like my school, but I don’t think it’s worth the cost,” Kim said. “There are too many students in a class.”

Meyers said the Obama administration’s plan to provide relief to debt-ridden college graduates might not affect the debt students graduate with or influence students to be more cautious with the way they fund their education.

“The loan limits, the cost, those are fixed and don’t really have anything to do with how the students repay,” Meyers said. “If the student is planning on this repayment method, they might borrow a little more because they feel they will be able to handle the debt.”

Ballard said students who are trying to pay tuition expenses through extra hours at work might end up sacrificing quality of their performance in class.

“Some students, faced with rising tuition, are working longer hours during the semester to pay their bills,” Ballard said. “If you’re working 40 hours a week at the 7-Eleven, it is harder to do well on your schoolwork.”

Discussion

Share and discuss “Rising tuition causes decrease in MSU’s value” on social media.